Our key takeaways

- Mortgage rates are unlikely to fall below 6% barring a recession

- Home prices will struggle to post gains in 2024, as a lack of affordability keeps demand down in the face of increasing for-sale inventory

- Near-record multifamily unit deliveries will push vacancy rates higher and place downward pressure on rents

- The health of the labor market will be the single largest determinant of housing market performance in 2024

Just like in 2023, now that we are a few months into 2024 the real estate market continues to be an ever-evolving landscape. The dynamic nature of market conditions has made it increasingly challenging to foresee what lies ahead in the housing market, and forecasts once again showcase a wide spectrum of possibilities, from officially reserved to remarkably positive.

The predictions from our 2023 forecasts — like mortgage lock-in, rental growth decline, and affordability issues — are all coming into play as we start 2024 and look toward the coming months. Whether you’re dreaming of buying a new home sometime in 2024, selling a property, starting out as an investor, or expanding your portfolio, these are the key factors that we see moving the real estate market this year.

Mortgage rates will struggle to drop below 6% barring a recession

A decline of almost 1.2% in mortgage rates between October 2023 and mid-January 2024 has had many analysts hopeful for deep cuts throughout 2024, bringing mortgage rates down and jumpstarting the real estate market for buyers and sellers alike. Fannie Mae, among others, is now projecting rates to dip into the 5% range in 2024. But we think that is too optimistic for two primary reasons:

1. Market repricing of rates has been far more aggressive than the Fed outlook

After the Fed meeting in December, futures markets priced in six quarter-point rate cuts in 2024, compared to three quarter-point cuts in the Fed’s most recent outlook. This large divergence helped fuel the sharp decline in mortgage rates in late 2023 by pushing down the benchmark 10-year treasury yield.

However, if the Fed sticks with its outlook and only cuts three times in 2024 (which seems likely after the January 31st meeting) this will create a significant headwind to declining mortgage rates as the 10-year treasury reprices to that reality. In short, the market is priced for aggressive cuts. If those do not materialize, it will put a floor under mortgage rates.

2. Elevated mortgage spreads are likely to persist

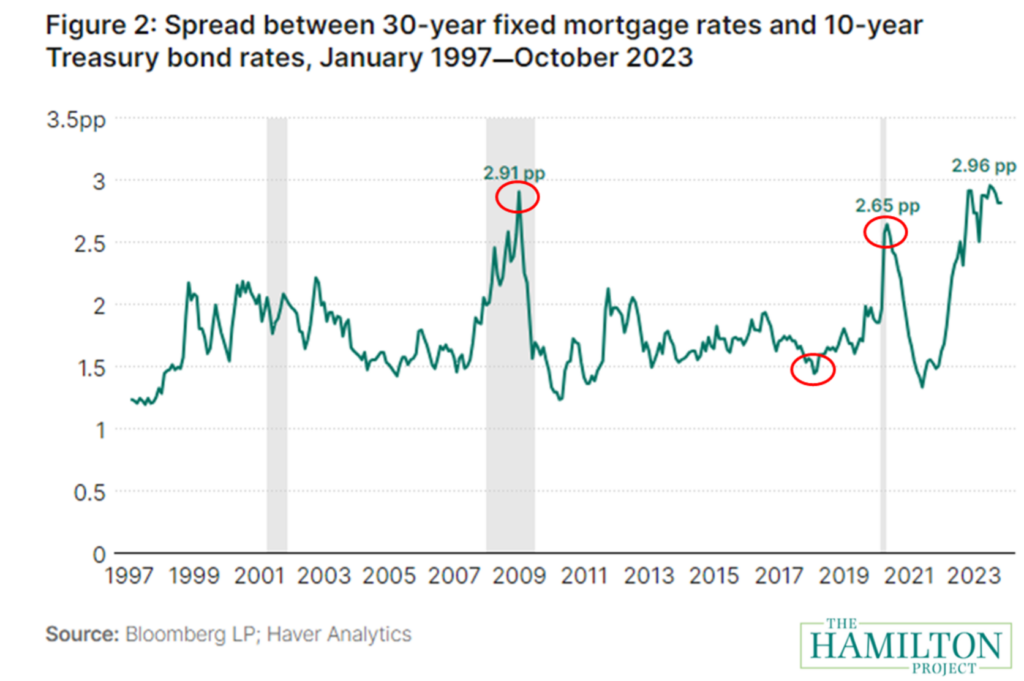

Since the Great Financial Crisis (GFC), the largest single buyer of agency mortgage-backed securities (MBS) has been the Federal Reserve — and they currently own approximately 30% of all agency MBS in existence. These purchases were intended to help stabilize the real estate market and support the economy during the turmoil of both the GFC and the pandemic by lowering the spreads on these securities and ultimately pushing down mortgage rates.

These purchases were extremely successful in accomplishing their objectives, as evidenced by the impact of key Fed moves over the years.

- 2008: Fed begins quantitative easing in the wake of the GFC, including purchases of agency MBS. As the Fed enters the market, spreads drop precipitously.

- Late-2017: Fed ceases MBS purchases and begins balance sheet runoff; spreads increase materially over the following two years.

- 2020: Fed begins large scale MBS purchases again in the wake of the pandemic; spreads once again quickly compress.

The ability for the Federal Reserve to influence mortgage spreads has been impressive. However, as we look deeper into 2024, there is little chance that the Fed will once again intervene to bring mortgage spreads down.

Inflation worries, an overheated housing market, and a continued desire for the Fed to shrink its balance sheet will all be obstacles for continued Fed support. While spreads compressed moderately in Q4 of 2023 as interest rates came down, our view is that the lack of Fed support will impede further material compression in 2024.

Low affordability will continue to stunt housing demand

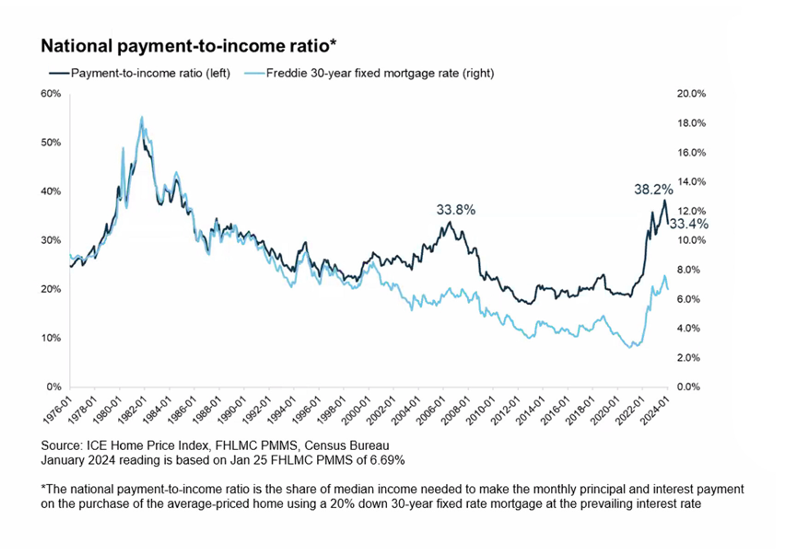

Despite the recent decline in interest rates, demand for mortgages has remained tepid and we expect this trend to continue in 2024. The fact is that — by multiple metrics — housing is historically unaffordable across the nation. Most would-be homeowners simply cannot afford to buy at current prices even if ample supply was available.

Despite a 1.2% decline in interest rates in the fourth quarter of 2023, the national payment-to-income ratio is still at levels matching the peak of the housing bubble.

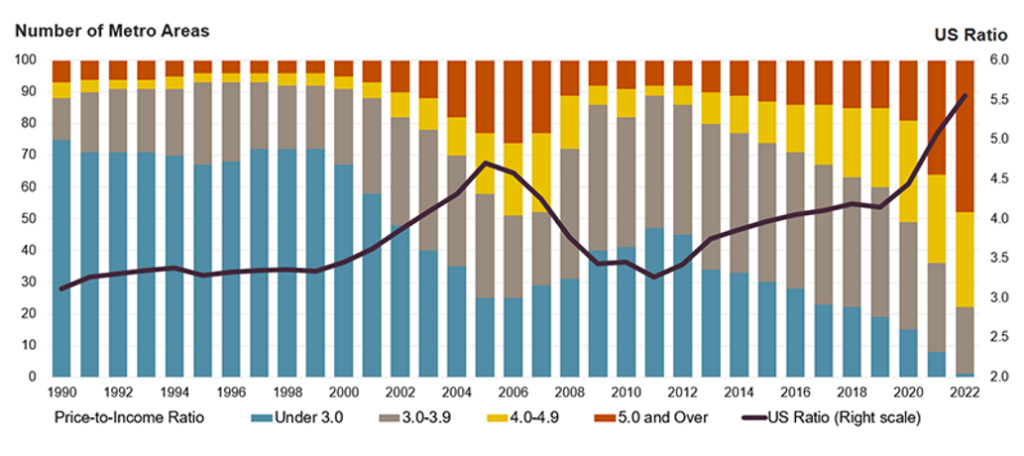

Furthermore, home price-to-income ratios have exploded in recent years, as home prices grew by 43% from 2019 to 2022 while incomes grew by just seven percent. Prior to the dot-com bust in the early 2000s and the GFC from 2007-2009, many large markets saw ratios of 3 or under. Even shortly before the pandemic in 2019, the ratio was around 4.

But today the combination of higher interest rates, accelerated appreciation, and tighter, more uniform underwriting have pushed the ratio to historic highs with many markets across the country seeing ratios of 5 or greater since 2022.

Much of the commentary on the housing market in 2023 was focused on low supply due to the lock-in effect of low seller mortgage rates, and this is undoubtedly a huge driver in keeping home prices elevated. However, our view is that the most important theme for 2024 will be weak buyer demand.

But isn’t there pent-up demand? Aren’t buyers on the sidelines ready to pounce? There certainly is a desire from potential homebuyers, but the data suggests that there is a big disconnect between what buyers want to do and what they are able to do given home prices, mortgage rates and incomes.

So what does this mean for investors? After navigating low inventory, high prices, and volatile rates in 2023, we see greater opportunities coming in 2024 — particularly in specific areas of the country where home inventories are beginning to rise.

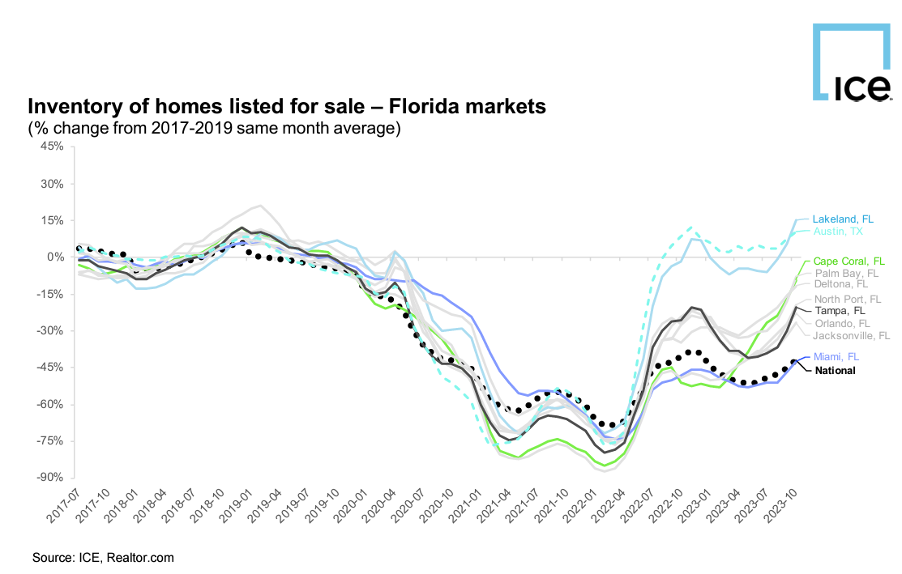

Our view is that increasing inventories paired with subdued buyer demand will ultimately provide buyers with more negotiating power to secure better prices and better terms on potential deals. This has already begun to play out in real estate markets such as Austin, San Antonio, and New Orleans, where increasing inventory has exposed weak underlying demand and put downward pressure on prices.

One area of the country that we are keeping our eye on is the state of Florida. After experiencing above average price growth since the pandemic, many markets in the state are showing an uptick in available supply, which would suggest they could be primed to become buyers’ markets sometime in 2024.

Targeting these areas, and others where inventories are moving back to or above 2019 levels, could provide investors with more attractive buying opportunities this year.

Pressure will increase on rental rates as vacancies climb

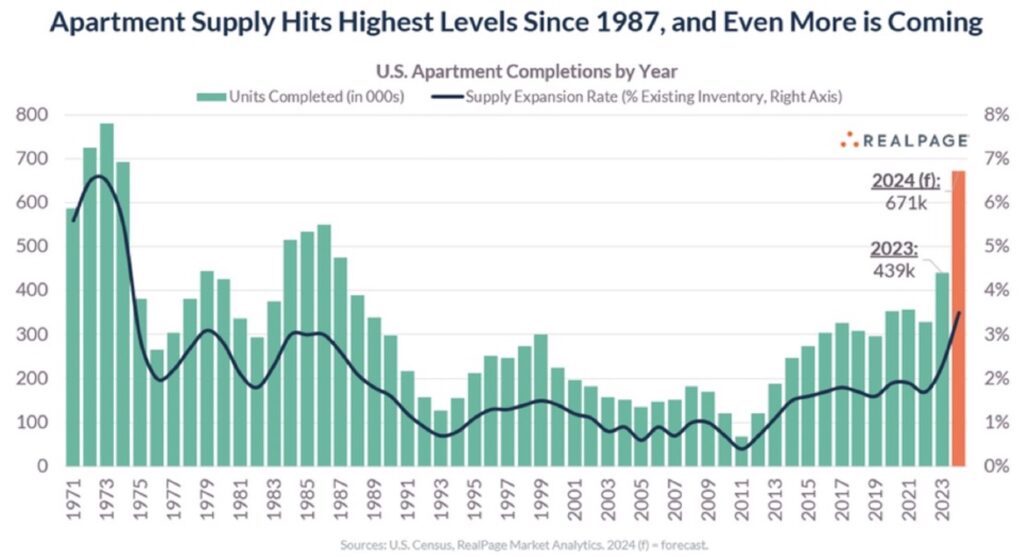

2023 saw rental vacancies climb throughout the year, increasing to 6.6% in the quarter and growing. Low interest rates in 2020 and 2021 saw a massive increase in multifamily housing starts, the bulk of which will be completed from 2023-2025. The 439K deliveries in 2023 were the highest since the 1980s, and 2024 deliveries are expected to increase by an additional 50% year-over-year.

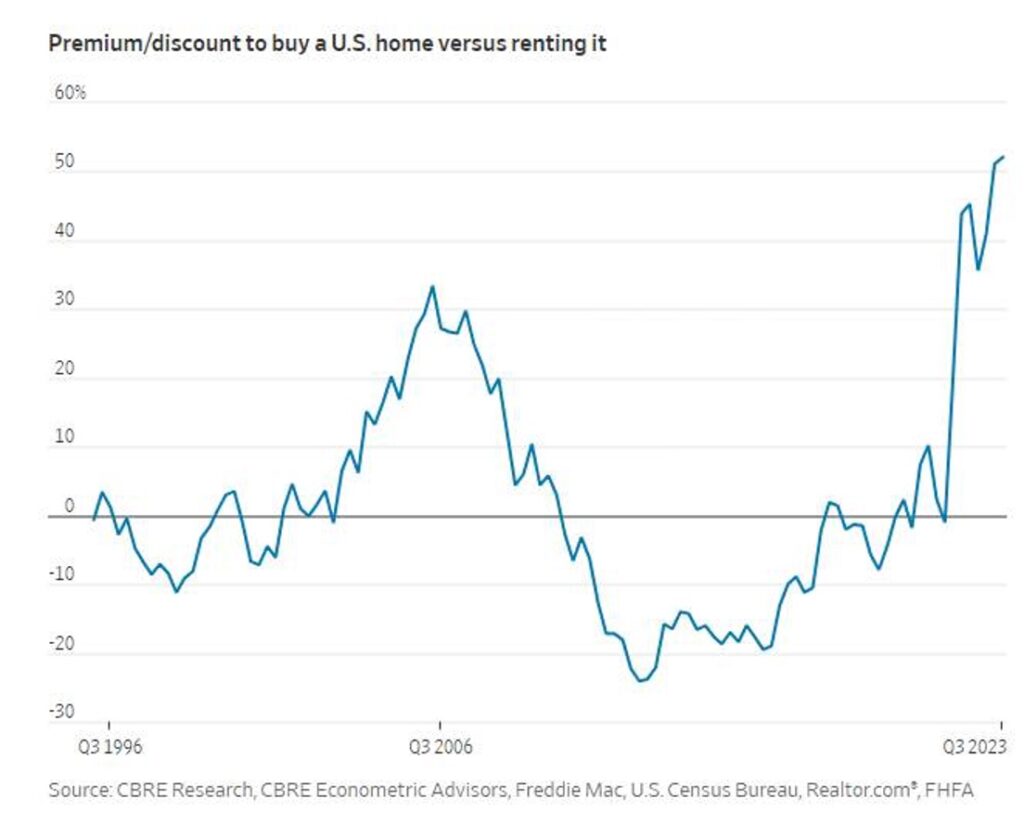

As a result, rental rates are trending downward as well with the rental market experiencing five straight months of declines in 2023. We are likely to see a continuation of this trend through 2024 as the continued growth in new supply increases competition among landlords for renters. This is likely to exacerbate the large disconnect between the cost of buying vs. renting, which is already at an all-time high.

For investors, it will be important to understand how this broad trend is playing out in the specific local markets where you are investing. The pressure on rents will likely be especially acute in areas with a high concentration of multifamily deliveries in 2024, such as Austin, Raleigh, Salt Lake City, and Phoenix. These areas have positive long-term growth trends, but investors will need to factor in near-term rent pressures as they look to add properties in these markets to their portfolios.

It’s still all about the economy

The US economy was remarkably resilient in 2023 in the face of multiple headwinds and defied wide-ranging calls for recession. Now, waning inflation, resilient consumer spending, and continued strength in the job market have analysts largely optimistic that the economy will see more growth, and that is the baseline scenario for our 2024 outlook.

However, there are a growing number of potential risks that the economy will have to navigate this year. Stress in commercial real estate, increasing consumer delinquencies, the exhaustion of pandemic-era excess savings, the resumption of student loan payments, and elevated geopolitical tensions all represent potential headwinds that could derail continued growth this year.

We continue to view the healthy labor market as the primary factor underpinning the strength in housing. If that continues, tight supply and stable prices will likely be the story a year from now. If not, we foresee a much more buyer-friendly real estate market on the horizon. Happy hunting in 2024!

Ready to dive in? Sign up for an account on Xome.com today and save property alerts to help you add new investments to your portfolio in 2023.